The decision to invest in rental properties often comes with a critical choice: managing short-term vacation rentals or long-term (usually residential leases). Each approach offers distinct advantages and challenges, impacting everything from revenue potential to maintenance responsibilities.

UNDERSTANDING SHORT VS LONG TERM RENTALS

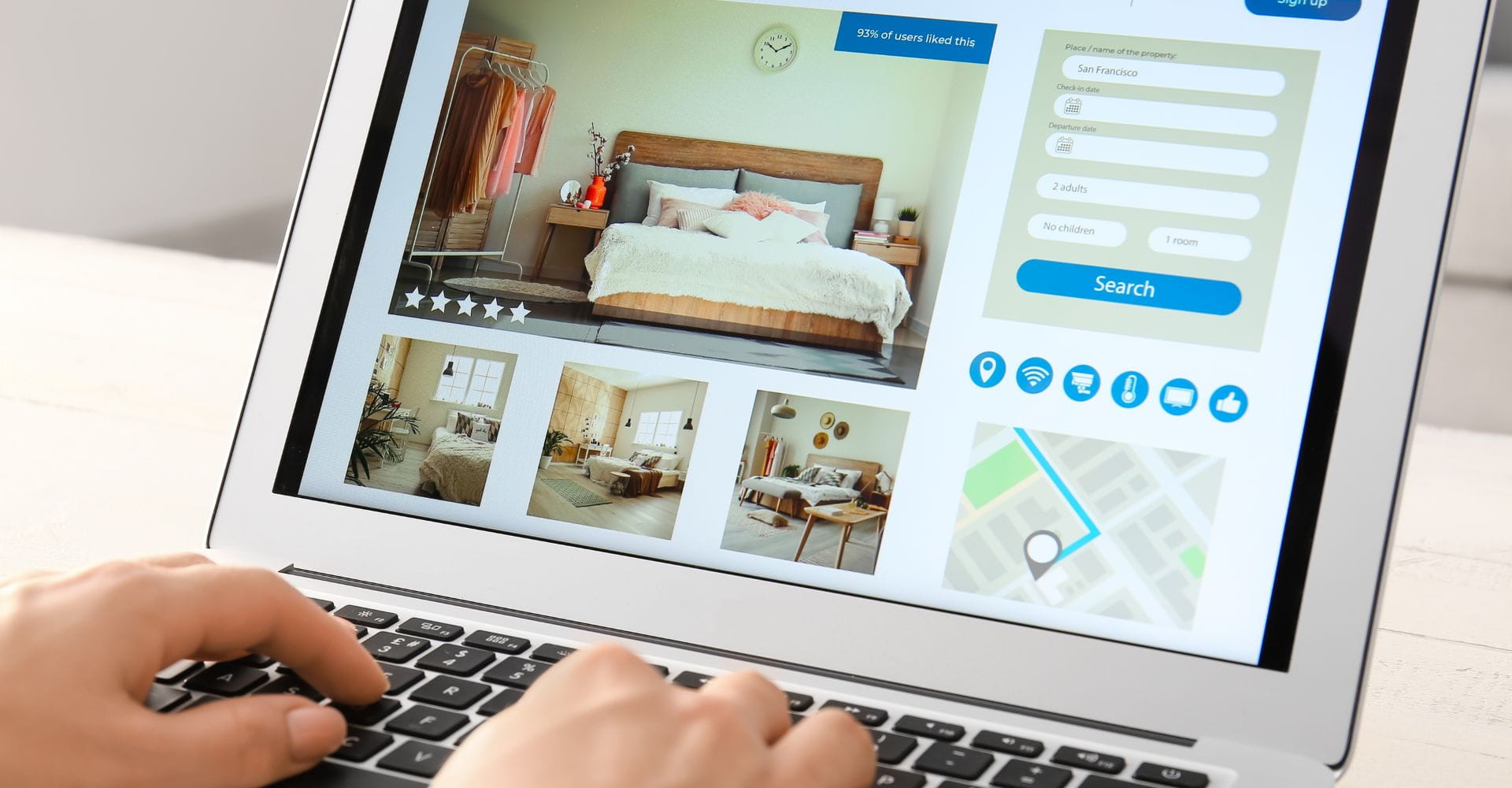

Whether you’re a property owner looking to maximize returns or a real estate investor deciding on the best strategy, understanding the key differences between short-term and long-term rentals is essential.

Income Potential and Pricing Strategy: Short-term rentals can yield higher annual returns but require active management and marketing, whereas long-term rentals offer reliability with less frequent pricing adjustments.

- Short-Term Rentals: Typically generate higher nightly rates, especially in popular tourist destinations or peak seasons. However, occupancy rates can fluctuate based on demand, requiring dynamic pricing strategies to maximize revenue.

- Long-Term Rentals: Provide steady, predictable income with fixed monthly rent. While rates may be lower compared to short-term rentals, the consistency of payments helps ensure financial stability.

Management and Maintenance: Short-term rentals require ongoing effort, while long-term rentals offer a more passive income stream with fewer operational demands.

- Short-Term Rentals: Demand hands-on management, including frequent guest communication, check-ins, cleanings, and restocking of essentials. Properties must be maintained in hotel-like condition to attract positive reviews and repeat bookings.

- Long-Term Rentals: Require less day-to-day oversight. Tenants are responsible for maintaining the property in livable condition, and management duties are typically limited to lease agreements, occasional repairs, and rent collection.

Regulations and Legal Requirements: Understanding local regulations is crucial before choosing a rental strategy to avoid potential legal and financial pitfalls.

- Short-Term Rentals: Many cities impose strict regulations, licensing fees, and zoning laws that limit short-term rental operations. Compliance with tax requirements, such as occupancy or tourism taxes, is also necessary.

- Long-Term Rentals: Subject to landlord-tenant laws, which typically provide tenants with more legal protections, including eviction restrictions and rent control in some areas.

Tenant Turnover and Vacancy Risks: Short-term rentals require strong marketing and pricing strategies to maintain high occupancy, whereas long-term rentals offer stability with minimal vacancy concerns.

- Short-Term Rentals: Higher turnover, meaning multiple guests may book throughout the year. While this increases revenue potential, it also raises the risk of vacancy if demand drops.

- Long-Term Rentals: Lower turnover with tenants committing to leases of six months or longer, reducing the risk of frequent vacancies.

Furnishing and Property Setup: Short-term rentals involve higher initial setup costs, while long-term rentals shift things like furnishing responsibilities to tenants.

- Short-Term Rentals: Must be fully furnished and well-equipped with amenities like WiFi, kitchen supplies, and entertainment options to attract guests. High-quality decor and maintenance are key to securing positive reviews.

- Long-Term Rentals: Typically rented unfurnished or semi-furnished, allowing tenants to bring their own belongings. This reduces upfront furnishing costs for the property owner. Some long-term rentals come fully furnished, too.

Choosing between short-term and long-term rentals depends on your financial goals, management preferences, and market conditions. Short-term rentals can provide higher revenue but require intensive hands-on management, marketing, and upkeep. In contrast, long-term rentals offer stability, fewer operational demands, and legal protections for landlords. Assessing your personal investment strategy and risk tolerance will help determine which rental approach aligns best with your objectives.

Are you looking for someone to ensure your vacation rental property runs smoothly and remains a profitable investment? Every owner who partners with East West Hospitality is connected with a team of property management services. Learn more about our property management services or call us at 888.598.6353.